Politics

Deep Blue Maryland Caught In Billion Dollar Web Of Unemployment Failure And Fraud

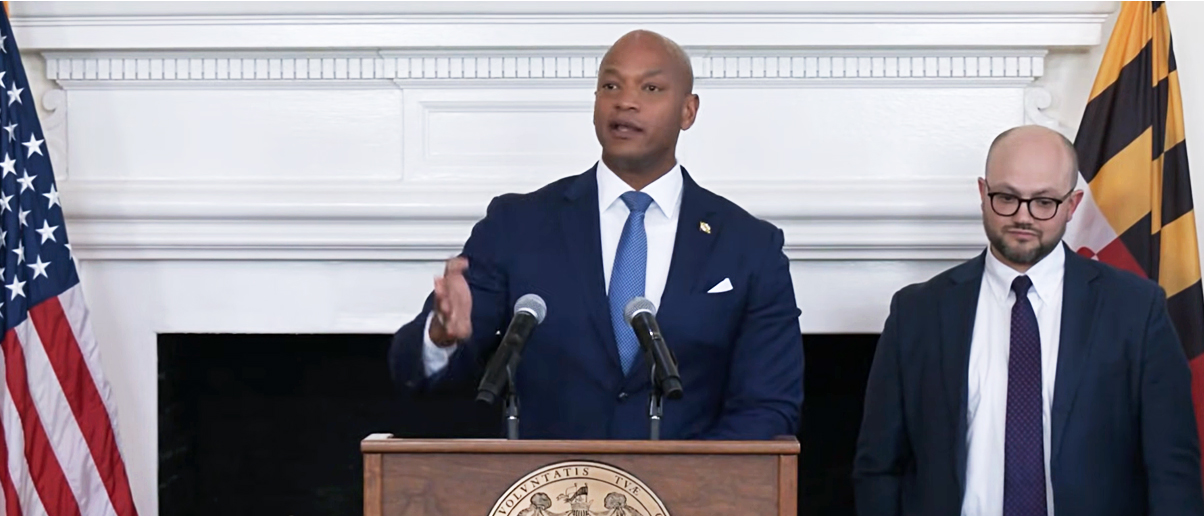

(via Gov. Wes Moore/YouTube)

Maryland is under public pressure after a state audit and a series of federal indictments exposed widespread fraud in its unemployment program.

Maryland has paid out close to a billion dollars in unemployment overpayments over the past five years to individuals who were not eligible to receive them, a damning audit of the Maryland Department of Labor has found, much of which has yet to be recovered. At the same time, federal prosecutors are continuing to bring cases tied to identity theft and pandemic-era fraud within the state’s unemployment insurance (UI) program.

Republican lawmakers say the scope of the problem has been clear for years and argue that the state government under Democratic Gov. Wes Moore has not moved aggressively to address it.

“We have a department that has over $800 million in outstanding receivables, including fraud, but getting that money back didn’t appear to be a focus for the Department of Labor,” Republican state Sen. Steven Arentz told the Daily Caller News Foundation.

The auditor’s report, published in early January, found that Maryland failed to “timely pursue recovery of claimant overpayments” totaling $807 million, of which $760 million is now considered uncollectible.

The Maryland Department of Labor says that overpayments can occur for several reasons, including unreported wages, changes in work availability, or identity theft or fraud by third parties, which the Department notes escalated during the COVID-19 pandemic.

The audit also identified internal control failures within the Division of Unemployment Insurance (DUI), which administers the UI program. Among those failures, the audit concluded that a lack of procedures requiring supervisory review of claims may have allowed fraud to go undetected.

Recent federal cases have highlighted the scale of the fraud in the state.

On Tuesday, Baltimore-area cousins Dekwii Woah-Tee and Daiwor Woah-Tee were indicted for allegedly running a six-year identity theft scheme that sought roughly $550,000 in fraudulent unemployment benefits from the state.

In a separate case, two Maryland men and a Virginia-based co-conspirator were sentenced for stealing more than $300,000 from Maryland and California by using stolen Social Security numbers to apply for COVID-era unemployment benefits.

A Nigerian citizen was sentenced in November for his role in a conspiracy to fraudulently obtain UI benefits in Maryland and California. In early January, three Baltimore residents were sentenced to years in prison for stealing the identities of mentally impaired victims and using them to claim more than $167,000 in benefits. Another defendant pleaded guilty in August to filing fraudulent UI claims in multiple states, including Maryland, resulting in losses between $550,000 and $1.5 million.

These and other schemes were identified by the DOJ’s Maryland Strike Force, which focuses on large-scale, multi-state COVID-19 relief fraud perpetrated by transnational actors and criminal groups.

Much of the fraud in the UI system occurred during the pandemic, when emergency federal programs rapidly expanded unemployment eligibility. Maryland Democrats have tried to blame the failures on Republican Gov. Larry Hogan, who served from 2015 to 2023.

“Roughly 90% of these overpayments were incurred under the prior administration, which turned off the mandated process for recovering overpayments, directly leading to the backlog that we are addressing,” Maryland Department of Labor spokesperson Dinah Winnick told the DCNF, a comment Moore’s office referred to but did not expand on.

Republican state Sen. Justin Ready, who, along with Arentz, is a member of the state’s Joint Audit and Evaluation Committee, told the DCNF that while many of the overpayments occurred years ago, the current administration has failed to follow up adequately.

“To be charitable to the current people, a lot of these overpayments probably did happen a while ago, but there was a follow-up that didn’t continue,” Ready said. “If it was really the previous governor’s fault, why didn’t the Moore administration come out and say they discovered a huge screw-up by their predecessor, who’s a political enemy?”

90% of this happened under Republican Larry Hogan.

Maryland has recovered over half a BILLION in over payments. https://t.co/BsSMljBBKK— Ammar Moussa (@ammarmufasa) January 14, 2026

In July 2020, during the early months of the pandemic, the Hogan administration announced the discovery of a criminal enterprise involving more than 47,500 fraudulent unemployment claims totaling over $501 million. The scheme exploited stolen identities and vulnerabilities in the federal Pandemic Unemployment Assistance (PUA) program under the Coronavirus Aid, Relief, and Economic Security Act.

State officials uncovered the fraud after detecting a sudden spike in out-of-state PUA claims, and responded by freezing out-of-state accounts, blocking payments and notifying federal authorities. By June 2021, the Hogan administration had flagged more than 1.3 million potentially fraudulent claims.

A September 2024 report prepared by the House Oversight Committee found that the state’s “quick and decisive actions … helped shed light on related fraudulent criminal activity in other states.”

But part of the state’s collection efforts was later stalled by a January 2022 legal challenge, which did not lift until September 2023. Even after the suspension ended, auditors found the department under Moore’s leadership failed to adequately pursue an additional $33.6 million in overpayments.

Winnick said the department recovered over $520 million in potentially fraudulent UI overpayments in 2025 and that it continues to recover overpayments on a daily basis.

In early January, the state began mailing more than 180,000 letters notifying residents to repay unemployment benefit overpayments. The letters are part of an effort to collect over $1.3 billion in overpayments, much of which was stolen through fraud, Maryland Labor Secretary Portia Wu told WBAL-TV 11 News.

Some recipients, however, claim they never collected unemployment benefits or believe their identities were stolen. Arentz and Ready said their offices have received numerous calls from constituents regarding the letters.

“I’ve got people calling my office in a panic,” Ready said. “They’re saying they either didn’t get any unemployment, or two, they got unemployment but ….. followed all the rules.”

Claimants who are victims of identity theft will not be held responsible for returning associated overpayments, the Department of Labor told the DCNF.

Ready warned that losses from the UI trust fund — financed largely by employer contributions — could eventually lead to higher taxes for local businesses.

“The system is still solvent, but [lawmakers] were recently talking about raising what businesses have to pay into it,” Ready said.

Arentz, the longest-serving member of the Joint Audit and Evaluation Committee, said the unresolved fraud reflects a broader failure of oversight across state government.

“It’s a bigger issue than just a single audit,” said Arentz, pointing to a recent audit that found Maryland’s Social Services Administration failed to protect children in its care from sex offenders and neglected basic medical and dental care to thousands of vulnerable juveniles, including repeat findings dating back nearly two decades.

“I can fault the last administration, certainly, but you can’t keep saying that, well, it was the last guy,” Arentz said. “We have to have accountability.”

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].