Politics

Biden Pushed Crackdown On Those Avoiding Paying IRS Before Pardoning Tax-Evading Son

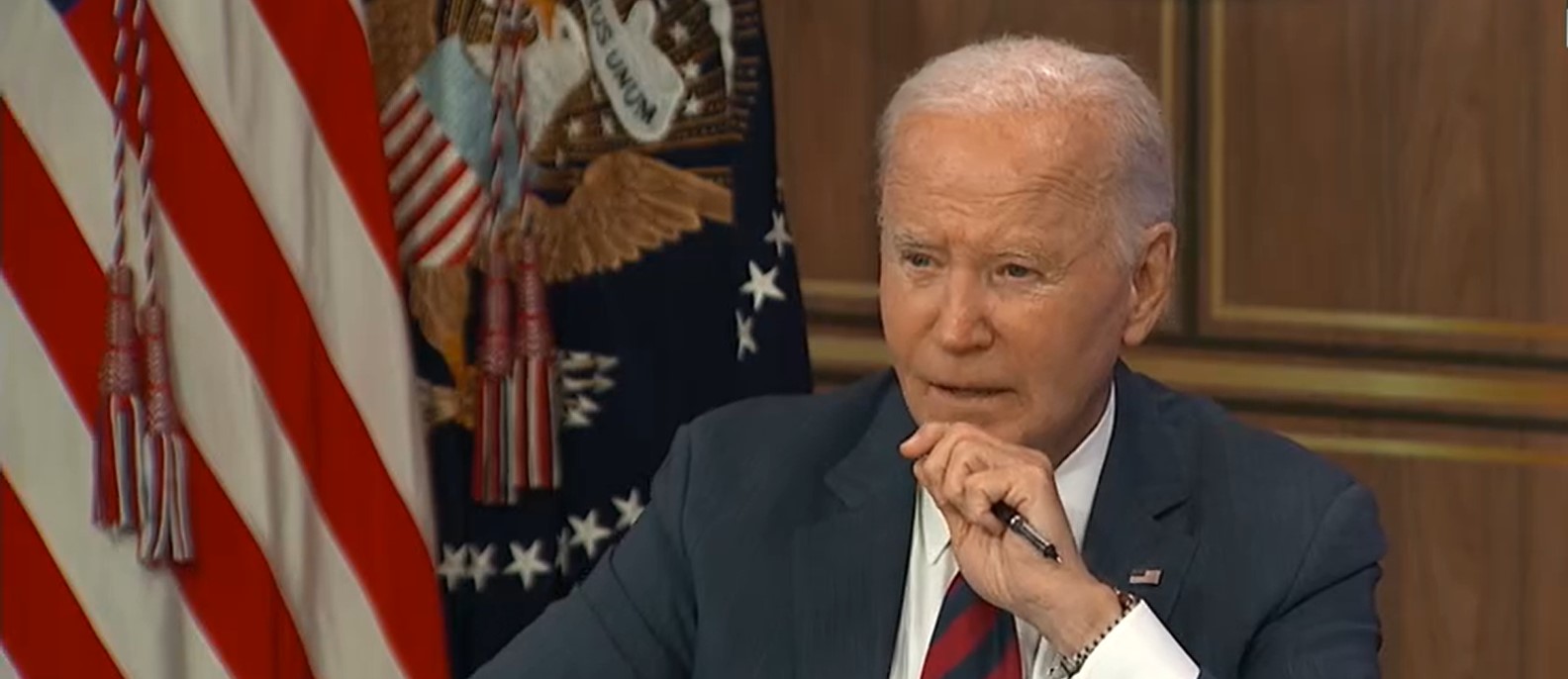

Screen Capture/CSPAN

President Joe Biden pardoned his son Hunter’s tax fraud charges Sunday after attempting to crackdown on tax evasion throughout his term.

Biden’s Inflation Reduction Act included $78 billion in funding to hire 87,000 employees for the Internal Revenue Service (IRS) as part of an effort to stop wealthy taxpayers from evading taxes and reduce the tax gap — the difference between what taxpayers pay and what they owe. Now, the lame duck commander-in-chief has pardoned his son Hunter Biden for committing some of the very same offenses the IRS expansion was meant to curb.

“The vast majority of [working] families do not contribute to the tax gap because they pay what they owe,” a February 2024 White House statement touting the IRS expansion stated. “It is long past time for the wealthiest households to do the same.”

Hunter Biden pleaded guilty to six misdemeanor and three felony tax charges in California in September after failing to pay at least $1.4 million in taxes and filing falsified tax paperwork, with prosecutors claiming he spent much of the money on an “extravagant lifestyle,” including “drugs, escorts and girlfriends, luxury hotels and rental properties.” Prior to his father’s pardon, Hunter faced up to 17 years in prison, with the sentencing hearing scheduled for Dec. 16.

After months of claiming he would not do so, President Biden pardons his son Hunter. @DailyCaller pic.twitter.com/uZ1dBCmj3t

— Reagan Reese (@reaganreese_) December 2, 2024

Despite his prior efforts to reduce tax evasion and his son’s guilty plea, Biden claimed Hunter was “selectively, and unfairly, prosecuted,” and was “singled out because he is [Biden’s] son.” Meanwhile, the average sentence for individuals sentenced for tax fraud in fiscal year 2023 was 16 months and involved a median total of $358,827 — a sum far smaller than the minimum $1.4 million that Hunter originally did not pay taxes on.

The Biden administration’s tax evasion crackdown also included a policy requiring Americans who collect payments of more than $600 via third-party platforms such as Venmo and Cash App report the funds to the IRS. The policy is specifically aimed at Americans running side hustles, small businesses and doing part-time work, not at reducing the tax gap for high earners.

Prior to issuing the pardon, Biden and White House press secretary Karine Jean-Pierre repeatedly promised the president would not issue a pardon for Hunter.

“I said I’d abide by the jury decision, and I will do that. And I will not pardon him,” Biden said during a joint press appearance with Ukrainian President Volodymyr Zelenskyy after a jury in Delaware convicted Hunter Biden on three charges in connection with the purchase of a Colt .38-caliber revolver.

The White House did not immediately respond to a request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].