Commentary: Big Tent Ideas

BOBBY JINDAL AND CHARLIE KATEBI: Dems, GOP Must Unite In Cracking Down On Middlemen Who Force

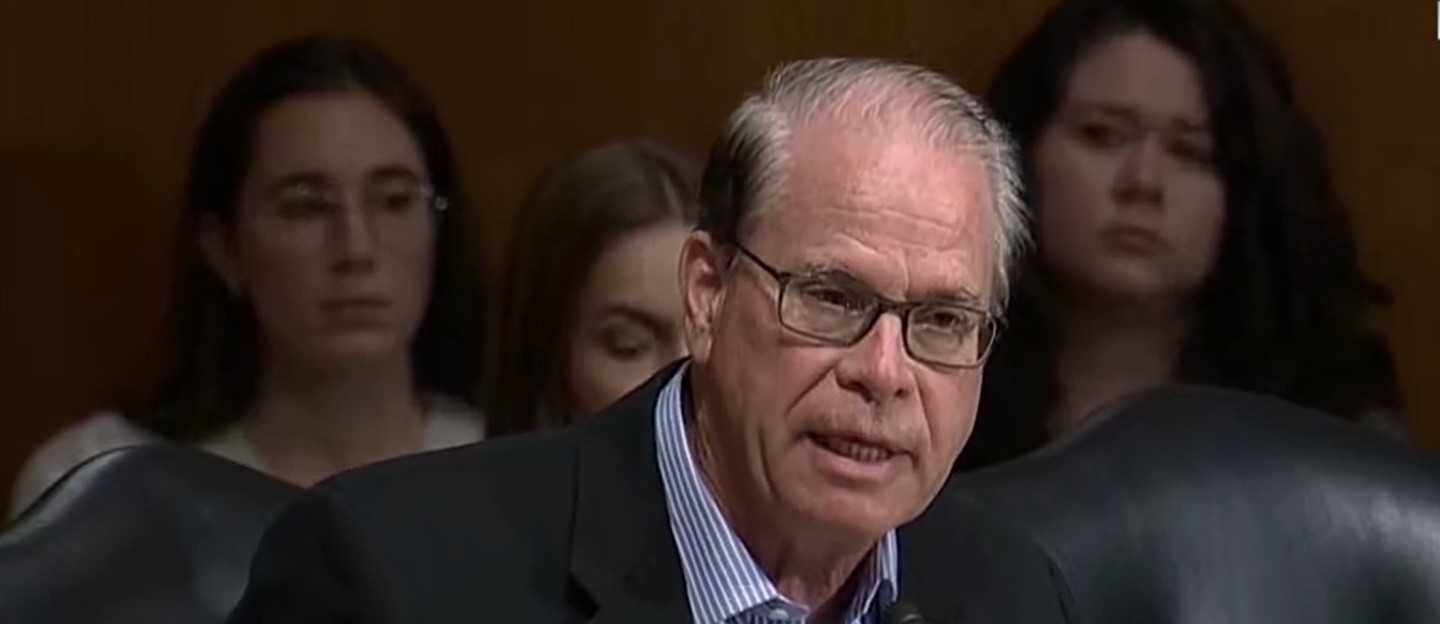

Indiana Gov. Mike Braun (Screen Capture/CSPAN)

Over the past several years, lawmakers, healthcare practitioners and patient advocates have claimed companies known as pharmacy benefit managers (PBMs) are inflating the cost of prescription drugs. Now, the Federal Trade Commission (FTC) is suing the largest PBMs for allegedly increasing the cost of insulin for patients with diabetes.

These middlemen manage the drug benefits for virtually all health insurance plans in the United States, negotiating prices with drug manufacturers and negotiating benefits with health plans. Since PBMs are service providers working on behalf of health plans and patients, they should be incentivized to design drug benefits so that patients can access the best drugs at the lowest possible cost. But, because of the perverse incentives in the market, PBMs often benefit when patients and their employers pay more for drugs.

Typically, PBMs negotiate a drug’s discount with the manufacturer on behalf of the health plan. This discount is commonly known as a rebate. These negotiations, between a manufacturer’s market access team and PBMs, center around how much of the drug can be sold and the discount that can be given based on the volume. Once the drug is sold to the patient, the rebate is passed from the manufacturer to the PBM to the plan. As payment for their services, health plans will pay their PBM a percentage of the rebate, theoretically incentivizing the PBMs to find them greater and greater rebates.

As detailed in the FTC report, the process has been warped by perverse incentives; first, it has led to negotiations where PBMs propose to block competition to name-brand drugs. Blocking competition to name-brand drugs increases the number of name-brand drugs used by patients, which increases the rebate paid by the manufacturer. This means patients who may want to access drugs sold by competing companies often face step therapy or higher cost-sharing, blocking patients from getting generic and biosimilar drugs. Regarding insulin, the agency alleged that PBMs chose to cover brand-name insulin drugs with higher list prices because they offer higher rebate payments. In exchange for these rebate payments, these middlemen excluded less expensive insulin products from their coverage. Another high-profile case alleged that the PBM financially punished doctors and pharmacies who dispensed a drug made by their competition: the cheaper biosimilar.

That is not the only perverse incentive. PBMs are allowed to design benefits that are detrimental to their client, such as health plans. However, the health plan has a federal obligation, a fiduciary duty, to operate the benefit “solely in the interest of the participants” of the plan.

The last perverse incentive is a well-intentioned provision of the Patient Protection and Affordable Care Act, known as the medical loss ratio (MLR). The MLR requires health insurers to spend 80–85% of a patient’s insurance premiums on medical claims, including pharmacy claims, and can keep 15–20% for overhead expenses and as profit. Since the percentage is capped, and not the dollar amount, the insurer could merge with a PBM, increase billed drug costs for patients, direct patients to only their pharmacies, and ultimately pay themselves back artificially high drug costs that would not pass muster in a fair marketplace. Instead of having an incentive to drive down costs, the MLR can incentivize the health insurance companies to increase them.

And that is exactly what happened. The biggest three PBMs are all integrated with an insurer, and all have a pharmacy of their own. One case study found that PBM-integrated insurers paid their own pharmacies 30% more than independently owned pharmacies, increasing out-of-pocket costs for seniors looking to fill their prescriptions.

Policymakers recognize the changes that need to be made to PBMs on behalf of patients. Both the House and Senate advanced legislation that would bring transparency to rebates and benefit design within private health insurance, Medicare and Medicaid. Sen. Elizabeth Warren (D-Mass.) and Sen. Mike Braun (R-Ind.) co-signed a letter regarding the need to investigate the role of the MLR in driving up insurance costs. Further, Braun and Republican Kansas Sen. Roger Marshall submitted an amendment that would place PBMs under the same fiduciary duty obligations as employers, making them equally responsible for the needs of the patient.

Our healthcare system should not be designed around the needs of middlemen. It should work for you, the patient.

Bobby Jindal served as governor of Louisiana (2008–16) and as a U.S. assistant secretary of Health and Human Services (2001–03). Charlie Katebi is deputy director of the Center for a Healthy America at the America First Policy Institute.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].