Energy

The Good, The Bad And The Ugly: Biden’s Climate Bill Turns Two Years Old

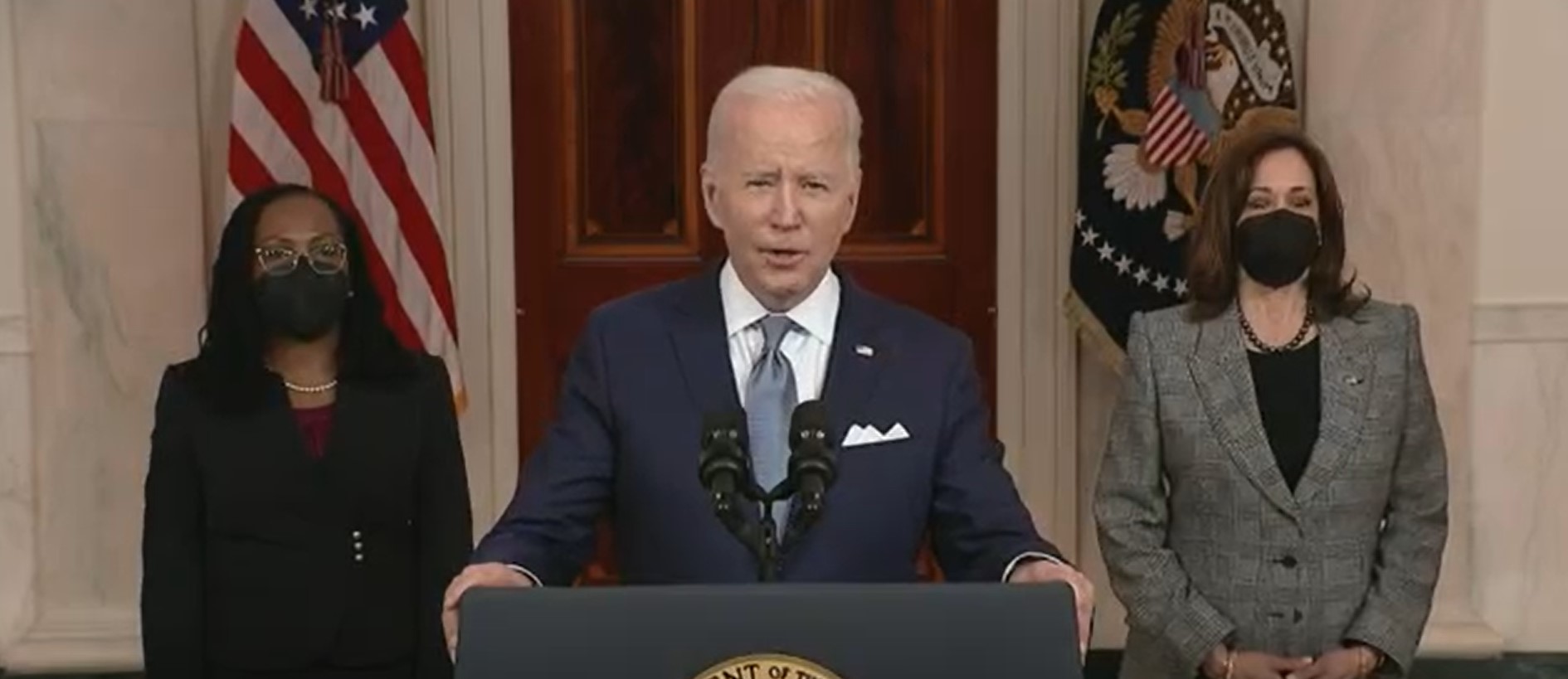

President Joe Biden, joined by Judge Ketanji Brown Jackson and Vice President Kamala Harris, announces that he is nominating Jackson to the Supreme Court, Feb. 25, 2022.

After two years, the results of President Joe Biden’s Inflation Reduction Act (IRA) include a growing price tag, energy market distortions, and large payouts to left-wing activist organizations.

Biden signed the IRA into law on August 16, 2022, hailing the massive legislative package as a transformative law that would help to usher in a new, green energy-fueled economy and create hundreds of thousands of jobs in the process. Two years in, the bill’s price tag has grown, IRA-backed industries like offshore wind are struggling, energy markets have been distorted and activist organizations and groups laden with Democratic Party insiders have been juiced with taxpayer cash thanks to the legislation.

Despite its title, Biden said in August 2023 that the IRA actually had “nothing to do with inflation” and that the bill’s massive green energy subsidies were really the law’s focus. The White House released statements on Friday from Biden and Vice President Kamala Harris celebrating the anniversary of the law’s enactment, with Harris proclaiming that she “was proud to cast the tie-breaking vote” to get the bill over the finish line in the Senate.

JANET YELLEN: “The Inflation Reduction Act is, at its core, about turning the climate crisis into an economic opportunity.”

Fantastic, what does the Inflation Reduction Act do to reduce inflation? pic.twitter.com/btsHoG3qd0

— Daily Caller (@DailyCaller) April 4, 2023

Initial estimates projected that the IRA contained nearly $400 billion worth of tax credits for energy, but the eventual total costs could end up being far greater, with Goldman Sachs projecting in April 2023 that the true cost of those credits could end up reaching about $1.2 trillion over ten years. In February, the Congressional Budget Office (CBO) increased its estimates for the cost of the IRA’s energy provisions through fiscal year 2033 by $428 billion.

“The bill that passed with Vice President Harris’s tie-breaking vote in the Senate will turn out to be one of the most expensive boondoggles in history. And it’s all based on the false premise that American citizens are too stupid to make decisions about how they heat their homes, do their jobs, cook their food and even the cars they drive,” Dan Kish, a senior research fellow at the Institute for Energy Research, told the DCNF. “It was never about the climate, but rather about increasing Washington’s power over industry and people in the U.S.”

JEAN-PIERRE: “The Inflation Reduction Act, when you think about fighting CLIMATE CHANGE, that is…so historic because it does the most….to fight CLIMATE CHANGE.”

What does the Inflation Reduction Act do to fight INFLATION? pic.twitter.com/jga7ftZWqM

— Daily Caller (@DailyCaller) March 30, 2023

Green Headwinds

Along with solar power and onshore wind, offshore wind is a green industry that some proponents expected to receive a boost from the IRA and its subsidies. Provided project construction starts early enough and developers meet additional pro-union and sourcing requirements, offshore wind projects can receive tax credits worth up to 30%, according to S&P Global.

However, the industry has recently struggled immensely as inflation, high borrowing costs and logistical problems have eroded projected profit margins. Major developers have terminated projects and sought to renegotiate their power purchase deals with states despite the administration’s efforts to push for an ambitious leasing schedule and provide generous subsidies.

The IRA’s funds for electric vehicles (EVs) have also struggled to prompt Americans to switch away from internal combustion engine models en masse. The IRA created a $7,500 consumer tax credit for people who purchase qualifying models to claim, but consumer demand for EVs has not yet taken off to the extent IRA proponents may have expected.

The IRA also contained subsidies meant to spur construction of EV charger stations in “low-income” and “non-urban” regions of the country, which tend to have far less existing infrastructure than more densely-populated coastal areas of the U.S. However, the DCNF discovered that some of America’s most exclusive locales — including parts of Nantucket and all of Fishers Island, New York — met the administration’s definitions for “low-income” or “non-urban” regions.

Additionally, the IRA makes billions of taxpayer dollars available for automakers to spend on preparing manufacturing facilities to produce EVs. Nevertheless, major manufacturers are losing considerable sums of cash on their EV product lines, and executives are backing away from some EV production targets while prices have fallen as the automakers attempt to appeal to hesitant consumers.

JOHN PODESTA: “To stop these disasters from getting even worse, we have to cut the carbon pollution that’s driving the climate crisis.

And that’s what the Inflation Reduction Act is all about.”

Does the Inflation Reduction Act do anything to reduce inflation? pic.twitter.com/vBVNQhzPsP

— Daily Caller (@DailyCaller) August 16, 2023

Mixed Bag

While conservatives and pro-fossil fuel organizations almost universally opposed the IRA before it became law, some groups that were initially against the bill have come around on some tax credit provisions now that they are in place. The American Petroleum Institute (API), a major oil and gas industry interest group, is one such entity; before the bill became law, API described the IRA’s tax and spending provisions as “the wrong policies at the wrong time.”

“We opposed the IRA, including a natural gas tax that should be repealed to avoid higher costs for consumers,” an API spokesperson told the DCNF. “We will continue to work with policymakers to preserve the [carbon capture and sequestration] and hydrogen incentives that advance innovation and benefit from bipartisan support.”

ClearPath, a pro-free market organization that advocates for innovative energy solutions that reduce pollution, never endorsed the IRA, but the group does think some credits in the law could have promise if implemented “correctly.”

“Tax incentives have been a valuable investment for American energy for decades, including a production tax credit from the 1980s to 2002 that helped make hydraulic fracturing technology commercially viable,” ClearPath CEO Jeremy Harrell said in a statement shared with the DCNF. “Done correctly, incentives can help scale up technologies while rapidly reducing costs — a combination that will keep the U.S. the global leader in energy production.”

“The Biden-Harris Administration has been dragging their feet on guidance to implement incentives from IRA,” Harrell continued. “Coupled with the broken permitting system in the U.S., the administration runs the risk of squandering the investments they have celebrated extensively.”

The law contains or otherwise enables some provisions — including a methane fee and a $5 per-acre filing fee for expressing interest in oil and gas leases on public lands — that effectively disincentivize oil and gas activity, Kathleen Sgamma, president of the Western Energy Alliance, told the DCNF. The higher costs that these provisions impose on producers will be passed on to consumers, according to Sgamma, an outcome that would contradict Biden’s assertions that the law lowers energy costs.

“As we’ve seen throughout the economy, the Inflation Reduction Act was really the ‘Inflation Acceleration Act,'” Sgamma said. “It certainly is that way with energy. When you make energy more expensive to develop and produce, that cost gets passed on to the consumer … suppressing supply means prices go up. That’s just basic economics.”

Sgamma added that she believes the IRA’s wind and solar subsidies to be “horribly ineffective and expensive to taxpayers,” but they are not enough on their own to distort markets to the detriment of consumers.

A potential repeal of the IRA is likely to be a hot topic in Washington if the GOP recaptures the White House and makes electoral gains in Congress in November. Former President Donald Trump has been fiercely critical of the IRA’s green energy spending, deriding flagship provisions as a “scam” that he promises to terminate immediately if elected.

However, Republicans hoping to walk back the entire law and claw back as much money as possible will have to deal with powerful lobbying interests — including API and the Chamber of Commerce — that will look to defend some of the bill’s provisions from repeal.

Congressional Republicans are not currently in lockstep on what to do about the IRA should they get the chance. While the bill became law without a single Republican vote, 18 House Republicans recently wrote to Speaker of the House Mike Johnson, urging him to consider preserving some of the law’s energy credits while getting rid of others.

BIDEN: “The Inflation Reduction Act is the most transformable – the transformational investment in our CLIMATE ever.” pic.twitter.com/iQR1PSxqDm

— Daily Caller (@DailyCaller) March 28, 2023

Activist Paydays

Beyond its subsidies for green technologies, the IRA also established federal grantmaking programs that are routing millions of taxpayer dollars to hardline left-wing activist organizations and entities full of Democratic insiders.

One such group is the Climate Justice Alliance (CJA), which the Environmental Protection Agency (EPA) announced as an awardee of $50 million to disseminate to other organizations as part of an “environmental justice” program endowed by the IRA. CJA describes its strategy as “building a Just Transition away from extractive systems of production, consumption and political oppression” and believes that “the path to climate justice travels through a free Palestine,” and its website features protest placards that feature pro-defund the police messaging and portray convicted cop killer Assata Shakur.

Other groups affiliated with coalitions cashing out on the EPA’s “environmental justice” cash from the IRA include the New Jersey Alliance for Immigrant Justice and the New York Immigration Coalition, two anti-immigration enforcement groups that do not appear to have much to do with environmental activism. The NDN Collective, a coalition partner of CJA, advocates for the release of convicted cop killer Leonard Peltier, and also supports racial reparations.

A separate EPA program funded by the IRA is also sending up to several million dollars to the Ella Baker Center for Human Rights and a partner organization to pursue a project that “will engage up to 1,350 individuals in California prisons and reentry communities to learn more about the unique environmental and climate justice challenges faced by these communities.” Another different EPA program established by the IRA is awarding billions of dollars to coalitions financing green projects that are laden with Democratic Party insiders and institutional allies.

The IRA is “handing out billions of dollars to companies to do what the government tells them as well as funding leftist green groups to get out the vote this fall,” Kish told the DCNF. “The more money they hand out, the more supporters they have. This is how third-world countries operate.”

The White House did not respond to a request for comment.

Featured Image: (Screen Capture/CSPAN)

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].