Foreign Affairs

Hiking Interest Rates May Have Been A Big Mistake

No featured image available

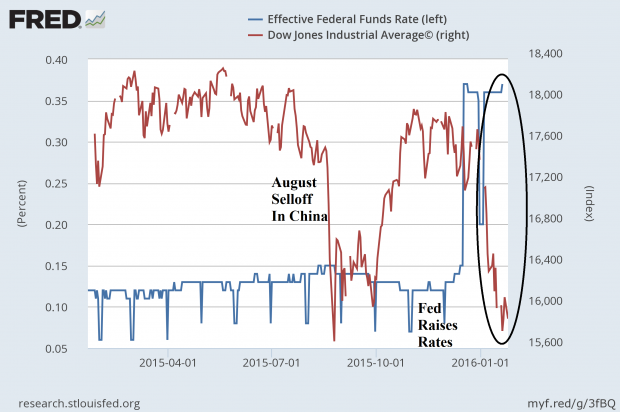

The U.S. stock market is off to its worst start in history, reflecting Federal Reserve policy and illustrating the potentially horrific ramifications of its decision to hike interest rates in December.

Since the Federal Reserve increased rates in December by 0.25 percent for the first time in a decade, stocks have slid. Some noted investors warn these are signs the recovery was nothing more than a façade created by the Federal Reserve, reports Financial Times.

After the financial crisis of 2008 interest rates were brought to record lows and the Fed began a program called Quantitative Easing, in which $4.5 trillion in new money was added to the reserves of Fed banks between 2008 and 2014. The chart below illustrates how the record breaking gains made in the S&P 500 track directly with the expansion of the U.S. money supply by the Fed.

Despite the record expansion of the money supply, economic conditions did not promote lending, leaving the new cash in bank reserves. This successfully stimulated stock market growth, launching the bull market of the past six years.

U.S. stocks similarly correlated with the Fed’s record low interest rates of the past six years. In the absence of continued monetary stimulation from the Fed and the December hike of interest rates the markets have pulled back, potentially reflecting their relative weakness.

The Fed will meet Wednesday to discuss plans to hike rates an additional four times in 2016, something experts are now calling unlikely. The Fed hoped the December rate hike would spur confidence in the economy, however pressure from China’s sputtering economy and low oil prices have cast a shadow on U.S. markets, reports CNN Money.

Experts argue the Chinese economy and it’s spillover into U.S. markets is simply a symptom of the larger problem; the manipulation and extreme overvaluation of global markets by central banks, reports Midas Letter.

“People say China’s to blame for all this mess, but China’s just a victim like the rest of us,” legendary billionaire investor Jim Rogers told Midas Letter’s James West. “We’re all victims James, we’re all victims, including American citizens. Our central bank has been a disaster.”

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].