Business

$403,434,000,000: Feds Collect Record Taxes for October—But Still Run $66,564,000,000 Deficit

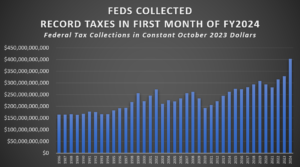

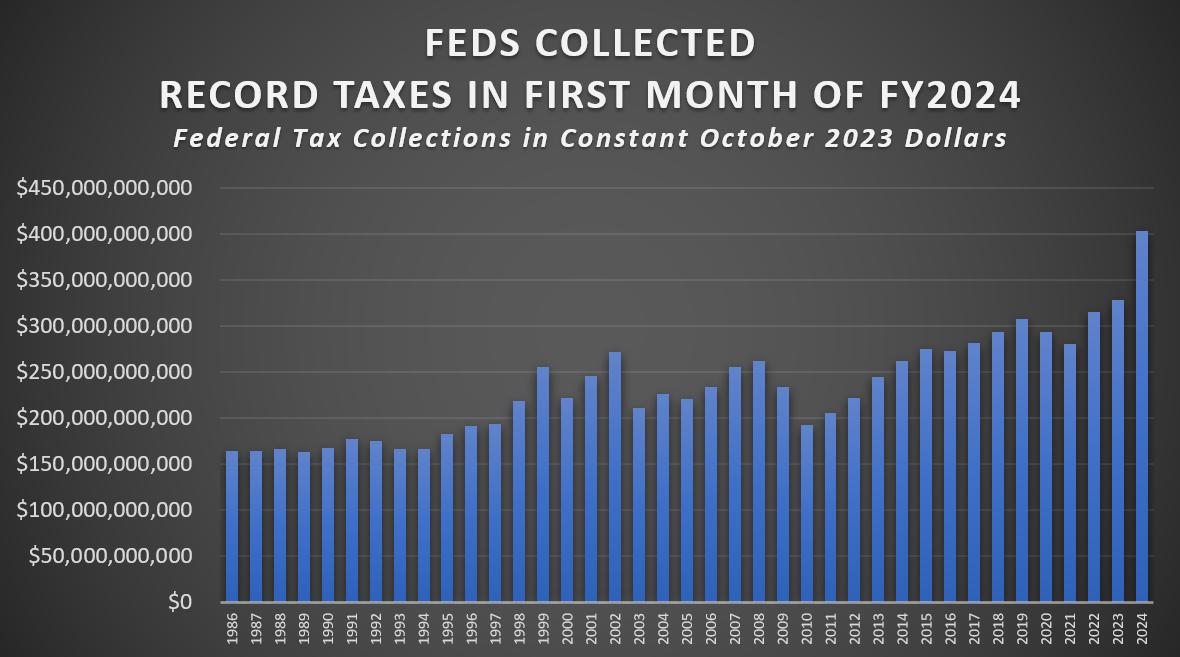

The federal government collected approximately $403,434,000,000 in total taxes in October, a record for that month, which is the first month of the fiscal year.

At the same time, according to the Monthly Treasury Statement, the federal government spent $469,997,000,000 during October—and ran a deficit of $66,564,000,000.

In October 2022, the first month of fiscal 2023, the federal government collected $318,500,000,000 in total taxes. When adjusted for inflation into October 2023 dollars (using the Bureau of Labor Statistics inflation calculator) that equals $328,823,050,000. That is $74,610,950,000 less than the federal government collected this October.

This October’s federal tax collections included $219,908,000,000 in individual income taxes; $114,210,000 in Social Security and retirement taxes; $7,263,000,000 in excise taxes; $4,460,000,000 in estate and gift taxes; $6,903,000,000 in customs duties; and $2,481,000,000 in what the Treasury categorizes as “miscellaneous receipts.”

The largest source of federal spending in October was the Social Security Administration, which spent $117,573,000,000, according to Table 3 in the Monthly Treasury Statement.

The second-highest source of federal spending was the Department of Health and Human Services, which spent $89,785,000,000 during the month. The third-highest was gross interest on Treasury Debt Securities, which cost $88,926,000,000. The fourth-highest was the Department of Defense-Military Programs, which spent $83,381,000 during the month.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].