Uncategorized

Warren Guns For The Wealthy In New Tax Proposal After Ocasio-Cortez Sets The Example

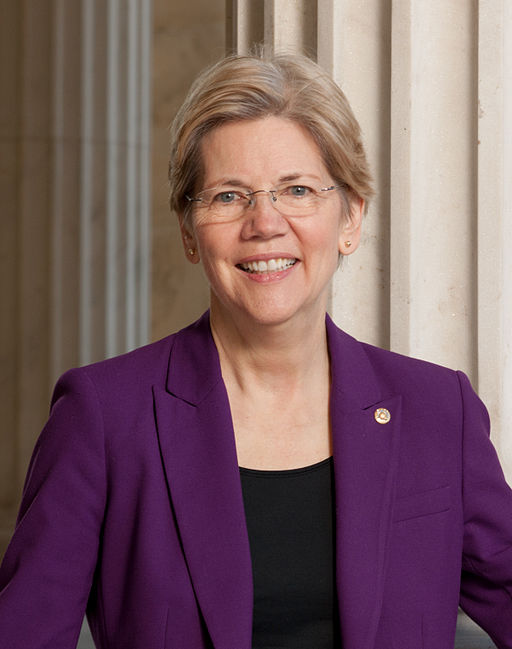

Elizabeth_Warren--Official_113th_Congressional_Portrait--

Democrat Sen. Elizabeth Warren of Massachusetts is expected to propose instituting a wealth tax on every American that possesses more than $50 million worth of assets, CNBC reports.

Warren’s tax proposal will affect less than 0.1 percent of U.S. households and raise $2.75 trillion over a decade, Emmanuel Saez, who advises Warren on economics, told CNBC. Warren announced her bid to run for president in 2020 on Dec. 31.

“We helped her with the numbers,” Saez said.

“America’s middle class is under attack,” Warren said in her 2020 announcement video. “How did we get here? Billionaires and big corporations decided they wanted more of the pie. And they enlisted politicians to cut them a bigger slice.”

In August, Warren distanced herself from the far-left wing of the Democratic Party. She has rejected the “socialist” label, saying she “believes in markets.”

Warren’s proposal comes several weeks after Democrat Rep. Alexandria Ocasio-Cortez called for a 70 percent tax on the wealthiest Americans at the “tippy tops” of income earners. Ocasio-Cortez, a self-identified democratic socialist, has built a significant following espousing far-left policy positions.

Ocasio-Cortez is expected to release her plans for a “Green New Deal” soon. The proposal will outline regulations and policies that will transition the United States to 100 percent green energy within roughly a decade. Her 70 percent tax is meant to fund the endeavor.

Warren has said she likes the “idea” of the green new deal, but has not made any concrete commitments.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].